Explore Your Earnings Statement

This page provides step-by-step instructions for understanding your Earnings Statement. Your Earnings Statement can be found at my.wisconsin.edu . Use the tabs below to view detailed information about sections included on the Earnings Statement:

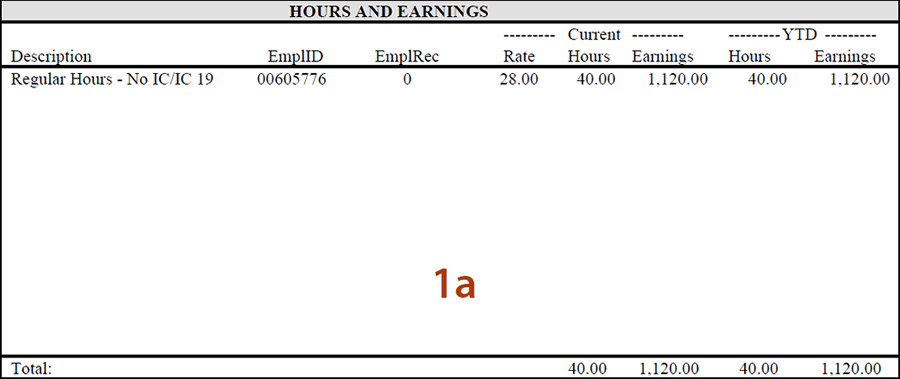

Hourly Jobs

- Description of the earnings type, listed by job record and earnings type code

- Current rate, hours and earnings amounts for the specific pay period, listed by job record and earnings type

- Year-to-date (YTD) sum of hours and YTD sum of earnings for that calendar year

- Total of all current hours and earnings (excluding earnings such as comp time and taxable fringes) and the total of all YTD hours and earnings

- Various other earning types split by job record, if applicable

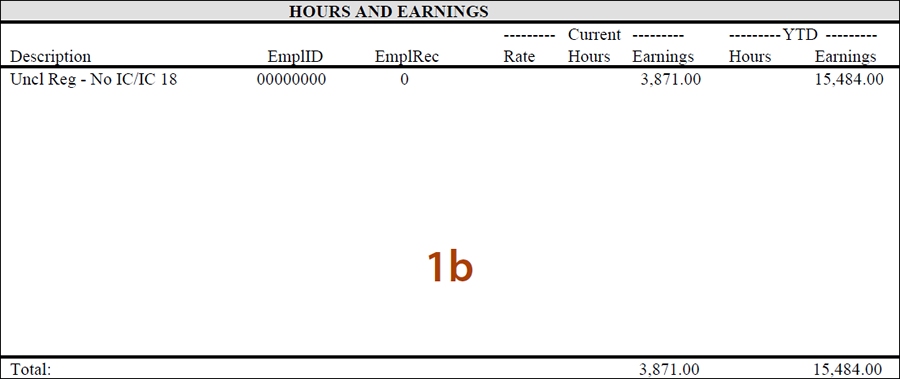

Salaried Jobs

- Description of the earnings type, listed by job record and earnings type code

- Current earnings amount for the specific pay period, listed by job record and earnings type

- YTD sum of earnings for that calendar year

- Total of all current earnings (excluding earnings such as comp time and taxable fringes) and the total of all YTD earnings

- Various other earning types split by job record, if applicable

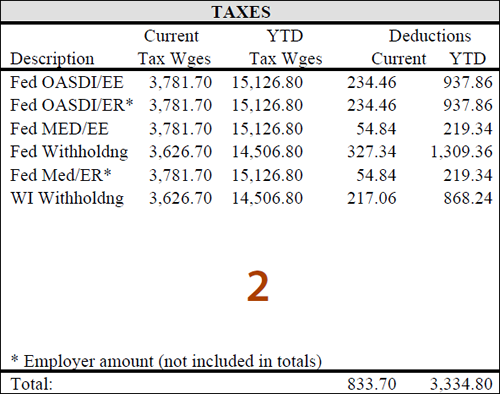

Fed/OASDI/EE

- Federal employee paid Social Security Tax

- Current and YTD taxable wage and deduction amounts

Fed OASDI/ER

- Federal employer contributed Social Security Tax

- Current and YTD taxable wage and contributed amounts

Fed MED/EE

- Federal employee paid Medicare Tax

- Current and YTD taxable wage and deduction amounts

Fed Withholding

- Federal Withholding Tax

- Current and YTD taxable wage and deduction amounts

Fed Med/ER

- Federal employer contributed Medicare

- Current and YTD taxable wage and contributed amounts

Additional Medicare Tax

- Employees earning over $200,000 each year will be taxed an additional 0.9% from Medicare. This will appear as a separate tax.

WI Withholding

- State Withholding Tax

- Current and YTD taxable wage and deduction amounts

1042 Fed

- 1042 Federal Tax

- Current and YTD taxable wage and deductions

- Applicable to participating foreign nationals only

Other

- Includes taxable wages, or tax withholding based on the amount that will report on the annual W-2 form

- Note: State Group Health and State Group Life impact taxable wages

- Includes a total of all current tax deductions and a total of all YTD tax deductions

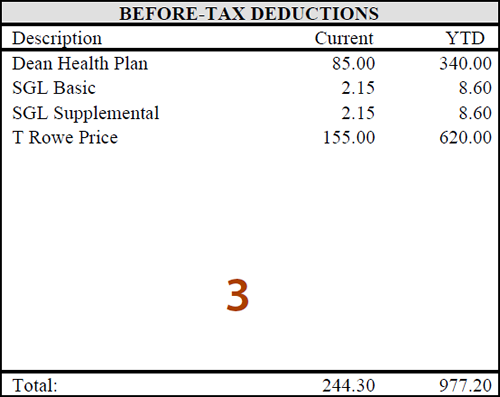

- Outlines the description of the employee before-tax deduction, or the amount deducted before taxes are calculated and deducted from earnings

- Includes the current amount and the YTD amount

- Includes total of all current before-tax deductions and all YTD before-tax deductions

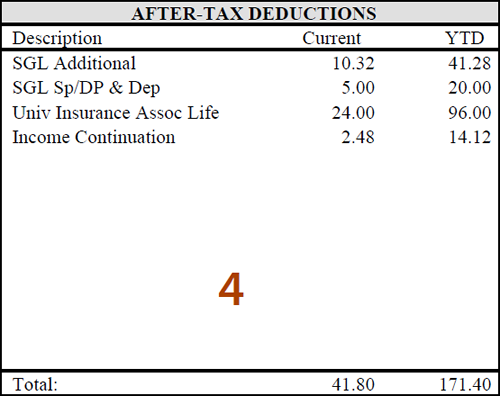

- Outlines the description of the employee after-tax deduction, or the amount deducted after taxes are calculated and deducted from earnings

- Includes the current deduction amount and the YTD deduction amount

- Includes total of all current after-tax deductions and all YTD after-tax deductions

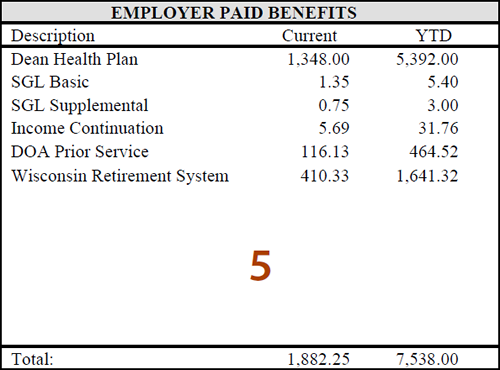

- Outlines the description of each employer paid benefit, the amounts contributed by the employer that do not impact an employee's individual earnings:

- Includes the current employer paid benefit amount and the YTD amount

- Includes total of all current employer paid benefits and total of all YTD employer paid benefits

- Includes Imputed Income for State Group Health and State Group Life, as noted with an asterisk to signify that the amount is taxable and impacts taxable wage amounts

- Review the benefit deduction schedule to determine which deductions are taken from each paycheck: Biweekly Pay Schedule

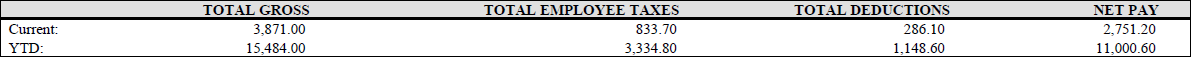

- Displays the Total Gross for current and YTD earnings, which corresponds to the total current earnings and total YTD earnings in Hours and Earnings section

- Displays the Total Employee Taxes for current and YTD taxes, which corresponds to the total current deductions and YTD deductions in the Taxes section

- Displays the Total Deductions for current and YTD deductions, which is a sum of all the current and YTD amounts in the Before-Tax Deductions and After-Tax Deductions sections

- Displays the current and YTD Net Pay amounts, which equal the amount the employee received on the paycheck for this period and total net for all periods paid in this calendar year

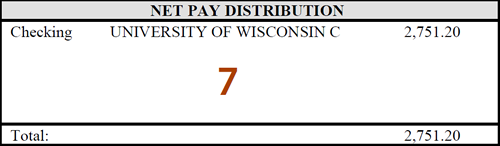

- Shows the net pay amount that the employee will receive for the specified pay period

- Indicates if an employee receives a paper check or if their earnings are directly deposited

- Shows the pay distribution between financial institutions, if the employee has created up to 3 direct deposits into different bank accounts

Additional information for employees with multiple job records

- Pay end date determines if employee will have pay earnings combined on one check

- If the pay end date of jobs are the same, the employee will receive one check with multiple earnings rows.

- If the pay end date of jobs are different, the employee will receive multiple checks for the pay period. Taxable gross is calculated from the earnings from ach check

- Earnings Statement will list all the employee's deductions and taxes, regardless of the job record from which they were deducted

- Earnings Statement will list all the employee's deductions and taxes, regardless of the job record from which they were deducted

- Earnings Statement reflects a “0.00” in the current amount field and includes the YTD deduction amount to denote that the deduction or tax was not taken from the job earnings on that pay period

- Deductions can be taken on one job earnings but not the other, and vice versa

- Earnings Statement will list all the employee's deductions and taxes, regardless of the job record from which they were deducted

Additional Benefits Information

- Use the Earnings Statement in conjunction with the Benefits Summary on self service

- Benefits Summary displays the plans in which the employee is enrolled

- Benefit deductions listed on the Earnings Statement show the cost paid for each benefits plan

- Summer Prepay deductions - the additional deductions taken on Spring paychecks for employees not receiving earnings during the summer - appear as a lump sum amount on the Earnings Statement

- The PREBTX deduction code combines all before-tax deduction amounts, including most medical-related premiums and a portion of State Group Life premiums.

- The PREATX deduction code combines all after-tax deduction amounts, including most life insurance premiums.

- Imputed Income

- Employees with a domestic partner not tax qualified and/or a dependent older than 26 years old where the employer share exceeds deductable amount:

- Indicated by two line items for health insurance, one being the taxable amount which will appear in the Employer Paid Benefits section

- Taxable amount, represented with an asterisk, will increase an employee's state and federal taxable gross

- Some employees may see before and after tax employee share

- Offset the increased amount paid by the employer

- Employees with a domestic partner not tax qualified and/or a dependent older than 26 years old where the employer share exceeds deductable amount:

Additional Payroll Information

- Taxes are paid to the penny

- Employees who have an Additional Withholding Tax amount and receive multiple checks will have this Additional Amount taken from each check each pay period.

Additional Time and Labor Information

- All hours will round to the quarter of an hour

- Overtime will be calculated for each individual week

- Hours exceeding regular hours will be classified as Overtime or No Pay, depending on whether the employee is Exempt or Non-Exempt

- Call back and night and weekend differentials will be paid based on the hours they actually worked, not based on the minimum amount of call back pay.

- Saturday night/Sunday morning Daybreaker hours will be placed on the day in which the shift started.

Related Topics

Related Topics